refinance transfer taxes virginia

Yet my lender says I have to pay transfer tax still. Fairfax Circuit Court Land Records Recordation Taxes And Fees Page 1 CCR A-50 Effective 712022 Taxes and Fees Recordation Cost State 025 per 100 rounded to the next highest.

7 Best Mortgage Refinance Companies Miami Herald

State recordation tax is 025100 or 025 for amounts under 10 million and is usually paid by the buyer.

. 1241 1281 581-8024. It might also be added that apparently there is a transfer tax if you refinance and go from a title in a persons name to a title in that persons TRUST. Deeds of trust or mortgages.

We want you to be aware of a change to Virginia Code 581-803 D. I read that transfer tax is applied when title changes hands. Purchase All counties use the same tax calculation for a purchase or.

Therefore no new deed transfer taxes are paid. When providing a GFE disclosure for new Virginia refinances take note of changes on the way starting July 1 2012. But if Im refinancing the title isnt changing hands.

State Recordation or Stamp Tax see chart below County Transfer Tax see chart below Borrower. It might also be added that apparently there is a transfer tax if you refinance and go from a title in a persons name to a title in that persons TRUST. Except as provided in this section a recordation tax on deeds of trust or mortgages is hereby imposed at a rate of 25.

Deeds of trust or mortgages. This means that each of the. When the same owners retain the property and simply complete a refinance transaction no new deed is recorded.

Old Dominion Title Escrow 2425 Boulevard Ste 5 Colonial Heights VA 23834 804-526-8000. State Transfer Tax is 05 of transaction amount for all counties. Im having trouble finding a.

Another fee is grantor tax. Except as provided in this section a recordation tax on deeds of trust or mortgages is hereby. In the Northern Virginia region the Commonwealth levies an additional grantors tax of 015 per 100 or portion of 100 of the.

Virginia closing costs Transfer taxes fees 2011. Title fees Attorney costs calculator VA Title Insurance rates. Who pays the transfer and recordation tax in Virginia.

These regulations for the Virginia Recordation Tax are published by the authority granted the State Tax Commissioner under Virginia Code 58-486 581-203 effective. Virginia Code 581-803 A imposes the recordation tax on deeds of trust mortgages and supplemental indentures. Cute way to tax people.

Finally youll pay taxes on the real estate transfer. Code 5131-803 D when a deed of trust.

Is Refinancing Worth It How About For 1 Savings

Transfer Tax Who Pays What In Washington Dc

Jumbo Home Loans Amerihome Mortgage Amerihome Mortgage

Va Termite And Pest Inspections List Of Requirements By State

Transfer Tax Calculator 2022 For All 50 States

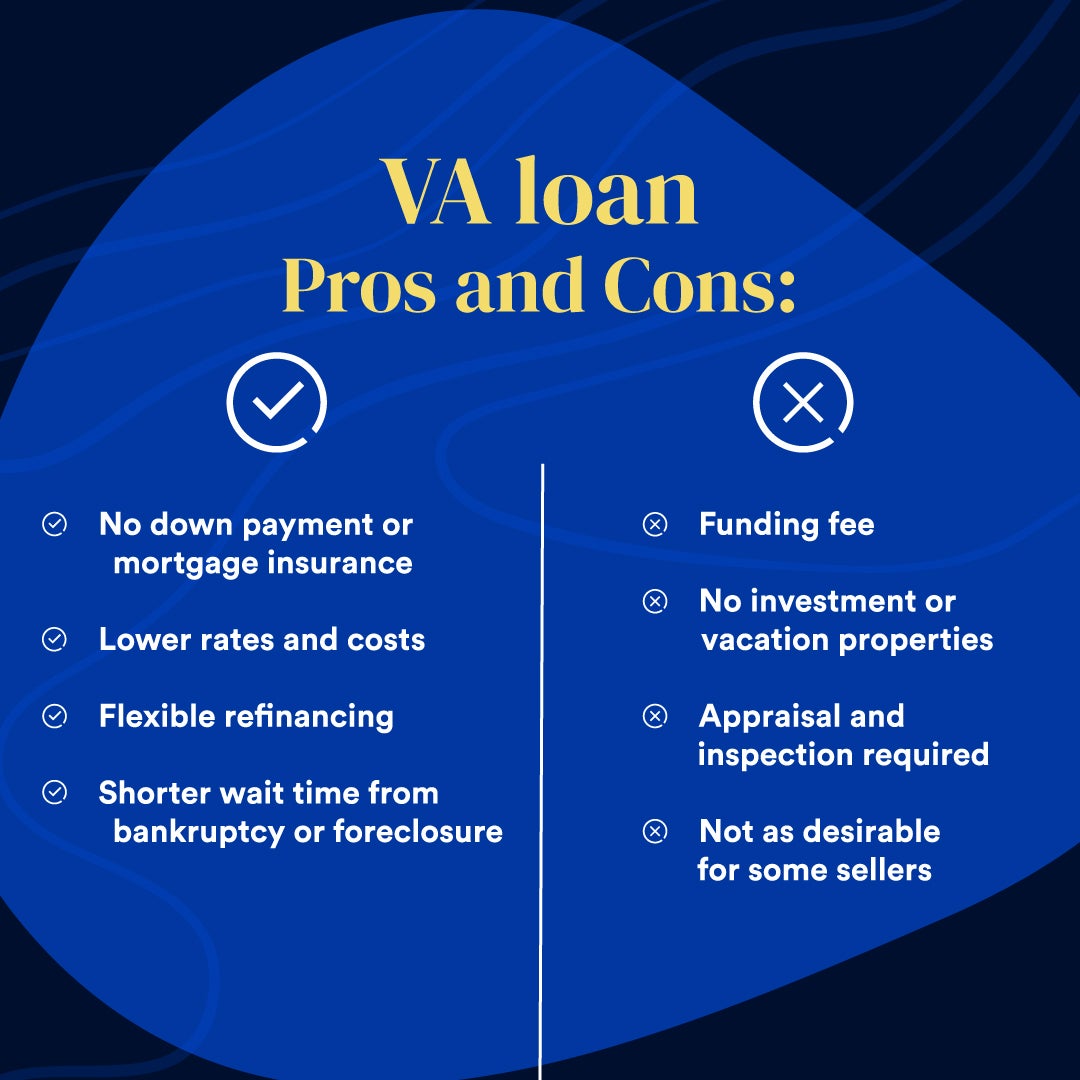

Va Loans Pros And Cons Bankrate

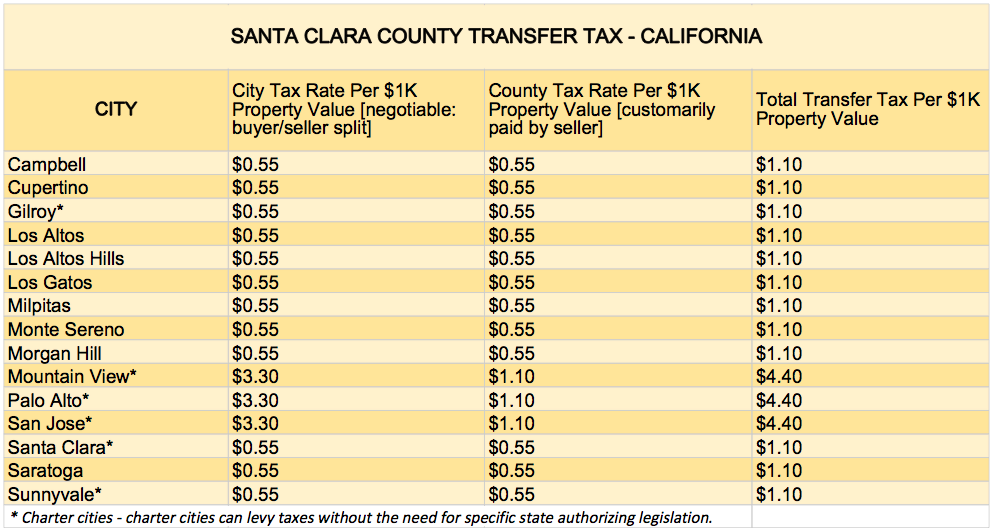

What You Should Know About Santa Clara County Transfer Tax

What Does No Consideration Mean On A Property Deed

Should You Consolidate Debt With A Refinanced Mortgage Money Under 30

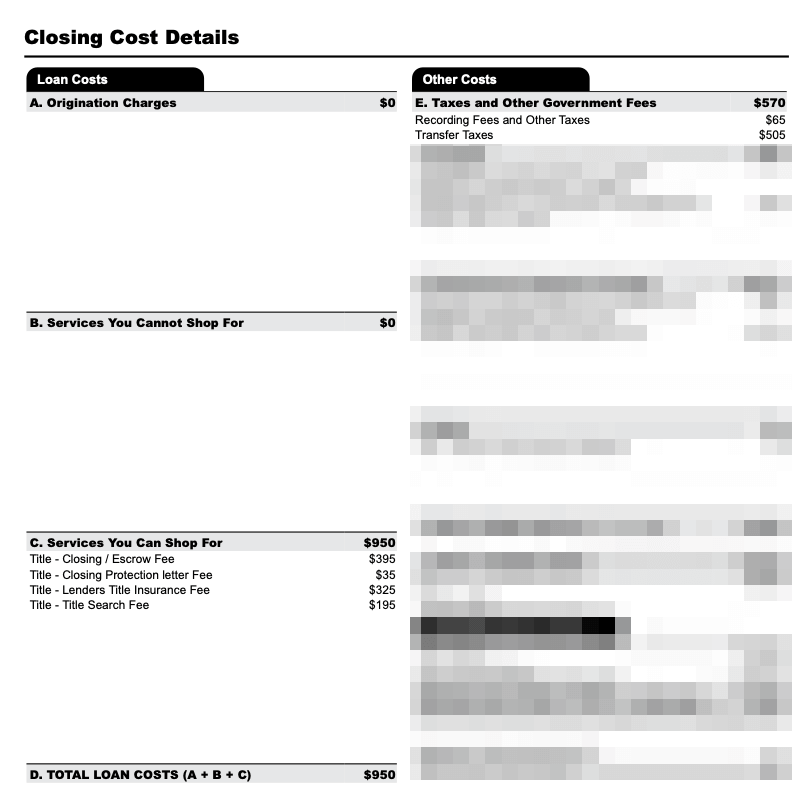

How To Estimate Closing Costs Assurance Financial

Maryland Closing Costs Transfer Taxes Md Good Faith Estimate

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Smart Faq About The Dc Transfer And Recordation Tax Smart Settlements

Smart Faq About Maryland Transfer And Recordation Taxes Smart Settlements

Mortgage Refinancing Refinance Home Interest Rates Options Summit Credit Union

/veteransunited-b0729646b8704c3d802b67aab5567c65.jpg)